15 February 2024

RESILIENT SCOTCH WHISKY INDUSTRY REACHES £5.6BN GLOBAL EXPORTS DESPITE “CHALLENGING” 2023

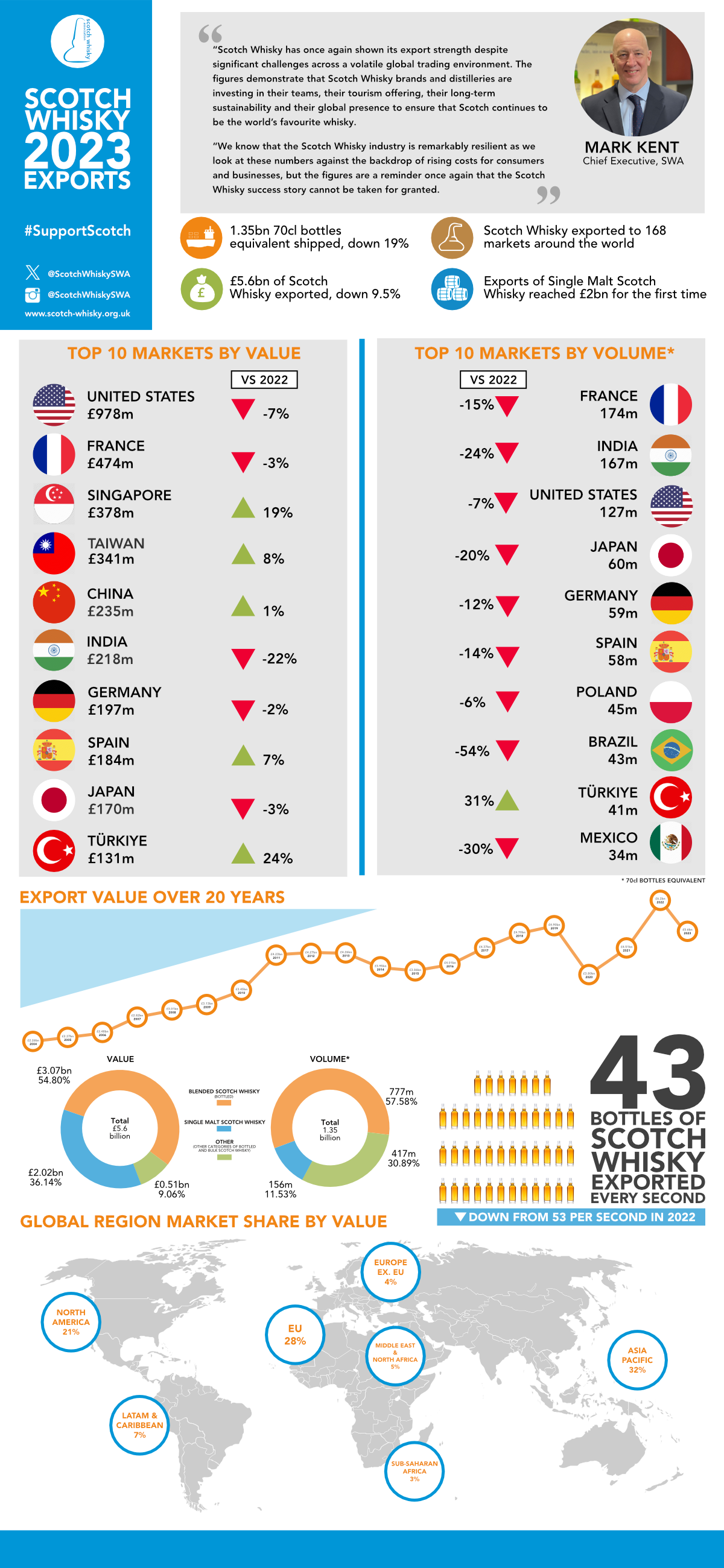

The figures, released today, show a decrease on 2022 exports for both volume and value, which the industry says was a “bumper” year for exports as global markets reopened and restocked following the pandemic, as well as the full reopening of global travel retail. The 2023 figures represent a more normalised depiction of the current state of global exports, with robust growth on pre-pandemic numbers. Exports of Scotch Whisky have risen by 14% in value compared to 2019, with a 3% increase in volume. However, whisky bosses have also warned that 2023 posed “significant” challenges for the sector both at home and in a number of key markets, warning that maintaining these numbers without more concrete government support in the coming year could hamper longer term growth.

As in 2022, Asia-Pacific continued to dominate as Scotch Whisky’s largest regional market by value in 2023, supported record value exports to China, a market up 165% on 2019, and value uplifts Singapore (19%) and Taiwan (8%). Premiumisation of Scotch Whisky remains a driver in these key markets: single malt Scotch Whisky continued to rise in popularity among a growing cohort of consumers, with double digit growth in China and Singapore on 2022.

Europe remained a key export region for Scotch Whisky for both volume and value, with France once again becoming the industry’s largest volume market – a position briefly held by India in 2022. Exports to India fell in volume and value compared to 2022, the fall coming against a backdrop of ongoing UK-India FTA talks and the Scotch Whisky industry’s calls for a trade agreement which lowers the 150% tariff on Scotch imports into India, which would lead to significant export growth to the market.

Download the 2023 infographic here.

The United States, which has long been Scotch Whisky’s biggest market by value, saw a sector-wide fall in exports of 7% compared to 2022, and 8.5% on 2019, to £978m. Industry figures say that these numbers are reflective of global economic conditions and rising living costs for consumers in the US, which remains a dynamic, competitive market for whisky, and the wider spirits category. Last year saw companies manage stock levels within market following restocking in 2022, and the industry expects the short-term export dip to realign over the course of 2024. However, the SWA has also warned that 2024 marks a halfway point for the five year removal of tariffs on single malt Scotch Whisky which were imposed in 2019, and has urged the UK government to press for longer-term tariff-free trade for Scotch in its talks with the US administration.

The export figures come a month on from the industry’s latest economic impact report, which showed that the contribution of the Scotch Whisky sector to the UK economy has reached £7.1bn annually, supporting 66,000 jobs across the UK.

“We know that the Scotch Whisky industry is remarkably resilient as we look at these numbers against the backdrop of rising costs for consumers and businesses, but the figures are a reminder once again that the Scotch Whisky success story cannot be taken for granted.

- Mark Kent, SWA Chief Executive

Mark Kent, Chief Executive of the Scotch Whisky Association said: “Scotch Whisky has once again shown its export strength despite significant challenges across a volatile global trading environment. The figures demonstrate that Scotch Whisky brands and distilleries are investing in their teams, their tourism offering, their long-term sustainability and their global presence to ensure that Scotch continues to be the world’s favourite whisky.

“We know that the Scotch Whisky industry is remarkably resilient as we look at these numbers against the backdrop of rising costs for consumers and businesses, but the figures are a reminder once again that the Scotch Whisky success story cannot be taken for granted. We need to see more tangible support from government both at home and in our priority markets in order to continue to grow our export numbers, and the resultant investment, employment and economic benefits that come with that.

“A cut to spirits duty in the Spring Budget would be a step in the right direction, giving the industry platform at home to push forward with international growth. Government must also do away with any notion of restricting the marketing of Scotch Whisky in Scotland, which would have a significant and lasting impact on the industry’s ability to generate future growth.”

UK Government Minister for Exports Lord Offord said:

“Scotch Whisky is a major UK exporting success story contributing billions of pounds to the economy and supporting thousands of jobs.

“We want the UK to be an export-led economy and reach a trillion pounds of exports a year by 2030. It’s fantastic to see whisky exports in 2023 continuing to outperform pre-pandemic levels as businesses take advantage of our free trade deals and expand into new markets around the world."

Notes to editors

For more information, please contact pressoffice@swa.org.uk

Summary

- Scotch Whisky exports were valued at £5.6bn in 2023, with 1.35bn bottles exported, equating to 43 bottles per second.

- The value of exports are down by 9.5% on 2022, but up 14% on pre-pandemic levels (2019). By volume, exports are down 19% on 2022, but up 3% on 2019 figures.

- Exports of Single Malt Scotch Whisky topped £2bn for the first time.

- Asia Pacific was the most valuable export region with exports worth £1.8bn, down by 1.4% on 2022, but up 45% on 2019.

- The US market, historically Scotch Whisky’s first £1bn market, dropped to £978m in export value for 2023, with 127m bottles exported. Value figures are down by 7% on 2022, and 8.5% on 2019; volume has fallen by 7% compared to 2022, and remains steady compared to 2019.

- India, Scotch Whisky’s priority growth market, had export value of £218m in 2023, down by 22% on 2022 but up by 31% on 2019. The equivalent of 167m bottles were exported to India in 2023, down by 24% on 2022, but up by 27% on 2019.

- The 2023 figures, which show a decrease on 2022 export numbers, demonstrate a more normalised depiction of year on year exports for Scotch Whisky, with figures up on pre-pandemic exports for volume and value. However, the industry is seeing a global cost of living crisis impact consumers in markets around the world, as well as stock management in-market, both of which accounted for a drop in exports.

Top 10 Markets

The largest export destinations for Scotch Whisky (defined by value) in 2023 (vs 2022) were:

USA: £978mm -7% (£ 1,053m in 2022) -9% on 2019 (£1.07bn)

France: £474m -3% (£ 488m in 2022) +10% on 2019 (£432m)

Singapore: £378m +19% (£316m in 2022) +26% on 2019 (£300m)

Taiwan: £341m +8.3% (£315m in 2022) +65% on 2019 (£205m)

China: £235m +1% (£233m in 2022) +165% on 2019 (£89m)

India £218m -22.5% (£282m in 2022) +31% on 2019 (£166m)

Germany: £197m -2% (£202m in 2022) +7% on 2019 (£185m)

Spain: £184m +7% (£173m in 2022) +2% on 2019 (£180m)

Japan: £170m -3% (£175m in 2022) +16% on 2019 (£147m)

Türkiye: £131m +24% (£99m in 2022) +178% on 2019 (£47m)

The largest export destinations for Scotch Whisky (defined by volume, 70cl bottles equivalent) in 2023 were:

France: 174m bottles -15% (205m bottles in 2022) +4% on 2019 (173m bottles)

India: 167m bottles -24% (219m bottles in 2022) +28% on 2019 (131m bottles)

USA: 127m bottles -7% (137m bottles in 2022) +0.04% on 2019 (173m bottles)

Japan: 60m bottles -20% (75m bottles in 2022) -1% on 2019 (60m bottles)

Germany: 59m bottles -12% (67m bottles in 2022) +20% on 2019 (50m bottles)

Spain: 58m bottles -14% (67m bottles in 2022) +2% on 2019 (57m bottles)

Poland: 45m bottles -6% (49m bottles in 2022) +39% on 2019 (33m bottles)

Brazil: 43m bottles -54% (93m bottles in 2022) -1% on 2019 (43m bottles)

Türkiye: 41m bottles +31% (£31m bottles in 2022) +177% on 2019 (15m bottles)

Mexico: 34m bottles -30% (£31m bottles in 2022) -34% on 2019 (51m bottles)

Regional data

In 2023, Scotch Whisky exports by global region (defined by value) were:

Asia Pacific: £1.8bn -1.4% vs 2022 (32% of global exports)

European Union: £1.6bn -2% vs 2022 (28% of global exports)

North America: £1.2bn -10% vs 2022 (21% of global exports)

Central and South America: £408m -45% vs 2022 (7% of global exports)

Middle East and North Africa: £267m -18% vs 2022 (5% of global exports)

Western Europe (ex EU): £167m +14% vs 2022 (3% of global exports)

Sub-Saharan Africa: £162m -21% vs 2022 (3% of global exports)

Eastern Europe (ex.EU): £42m +9% vs 2022 (1% of global exports)

Category data

In 2023, Scotch Whisky exports by category (defined by value) were:

Bottled Blend £3.1bn -16% vs 2022 (55% of global exports)

Single Malt £2.02bn +2% vs 2022 (36% of global exports)

Bulk Blend £173m -9% vs 2022 (3% of global exports)

Bottled Blended Malt £138m -1% vs 2022 (2% of global exports)

Bulk Blended Malt £117m -10% vs 2022 (2% of global exports)

Bulk Single & Blended Grain £54m -8% vs 2022 (1% of global exports)

Bottled Single & Blended Grain £26m +34% vs 2022 (0.5% of global exports)