Discover the trends behind global Scotch Whisky exports

SCOTCH WHISKY EXPORT FIGURES: 2025

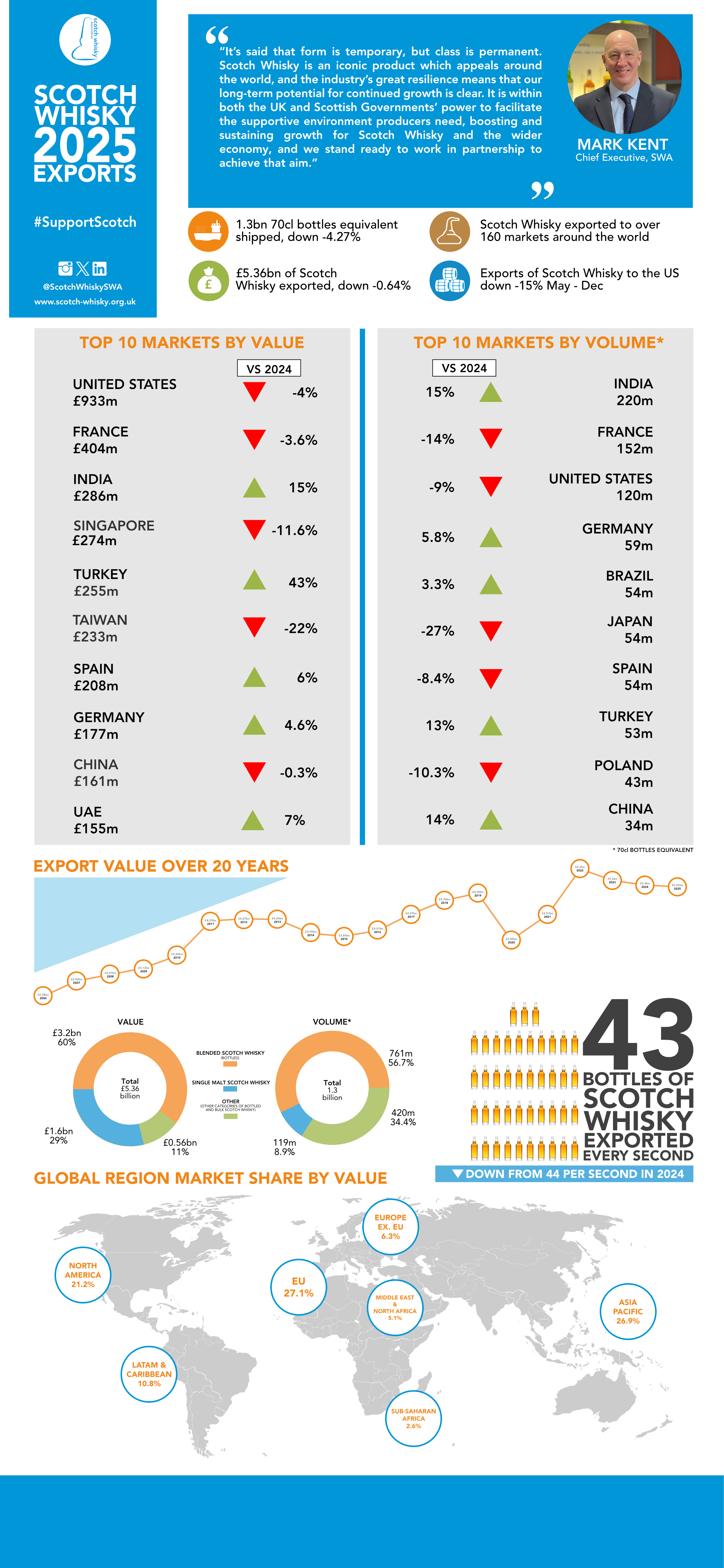

Scotch Whisky is the world's number one internationally traded spirit, with exports worth over £5.36bn in 2025. 43 bottles of Scotch Whisky were shipped every second to around 163 global markets, totalling the equivalent of 1.34bn bottles (70cl @40% ABV).

Scotch Whisky Association Chief Executive Mark Kent, and Interim International Director Emily Weaver Roads, on the 2025 export figures.

SWA Economist, Kathrin Furst, explains how the SWA collects and analyses the export figures.

KEY MARKETS

Here are some examples of markets where the SWA and our member companies work to improve access to the market for Scotch Whisky.

Americas

The United States was valued at £971m in 2024, with the equivalent of 132m bottles exported. This figure has fallen to £933m in export value in 2025, and the equivalent of 120m bottles exported over the full year; however these figures fell more significantly when examined from May to December, which show a fall of 15% by volume and 7% in value, as a result of the implementation of a 10% tariff across all categories in the US market in April 2025.

Asia Pacific

Asia Pacific, previously the Scotch Whisky sector’s most valuable regional market, saw a fall of -8.3% in value, with export volume remaining relatively steady (+0.08%) in 2025.

The Indian market has continued to grow, retaining its position as the industry’s biggest market by volume, and becoming its 3rd largest by value, with producers now looking ahead to the ratification of the UK-India FTA later in 2026 to further boost exports and enable long term market access opportunities. However, the industry has echoed findings in the recent report from the House of Lords, saying that in the short term, India’s future growth potential will not be enough to counter the widespread challenges that Scotch Whisky exports are facing.

APAC had seen significant growth over the past decade, but markets including China, Singapore, and Thailand have seen total export value decrease during 2025. Last month China’s tariff on whisky imports was halved to 5%, which the industry has said will help to re-energise exports to the market in 2026 and beyond.

Learn more about the Indian market here.

EU/Europe

The EU remains Scotch Whisky’s biggest regional market by volume and has reclaimed its position as the largest regional market by value. It totalled £1.5bn in exports in 2025 (down -1.8% on 2024), with the equivalent of 444m bottles exported (down -9% on 2024).

Key markets include France, which saw a -3.6% drop in export value to £404m, and -14% fall in export volume to 152m bottles, but remains in second place as the largest export market for both volume and value. Germany saw growth for both value (+4.6% to £177m) and volume (+5.8% to 59m bottles). Spain saw value growth of +6% to £208m, and volume decline of -8% to 54m bottles.

Markets including Turkey have seen a boost to exports by volume and value, as the industry navigated regulatory changes and global conditions. These market fluctuations are expected to level out in 2026 and beyond, with continued, steadier growth expected in the market.

Download the 2025 Scotch Whisky export infographic here

UK-India trade talks

Learn more about the importance of the Indian market for Scotch Whisky, and how the Scotch Whisky industry will benefit from a UK-India trade deal.

Discover the trends behind global Scotch Whisky exports news & commentary

SWA comments on deal to halve whisky tariffs in China

The SWA has welcomed news that Scotch Whisky tariffs in China will be halved to 5%

Scotch Whisky industry welcomes conclusion of negotiations on UK-Republic of Korea FTA

Negotiations on the UK-Republic of Korea Free Trade Agreement have concluded, delivering important improvements to the existing agreement.

First Minister joins SWA in Washington DC to press for zero tariff trade

SWA & DISCUS release joint statement on UK-US trade

The Scotch Whisky Association and Distilled Spirits Council of the United States share a joint statement on UK-US trade.