Pour Scores

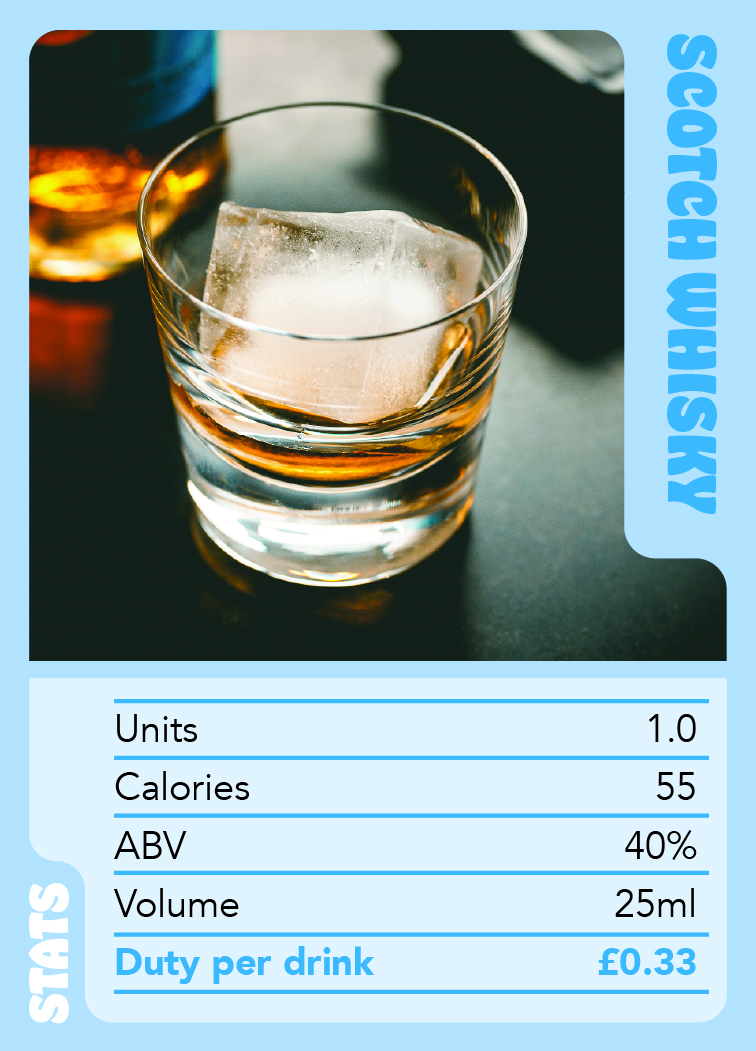

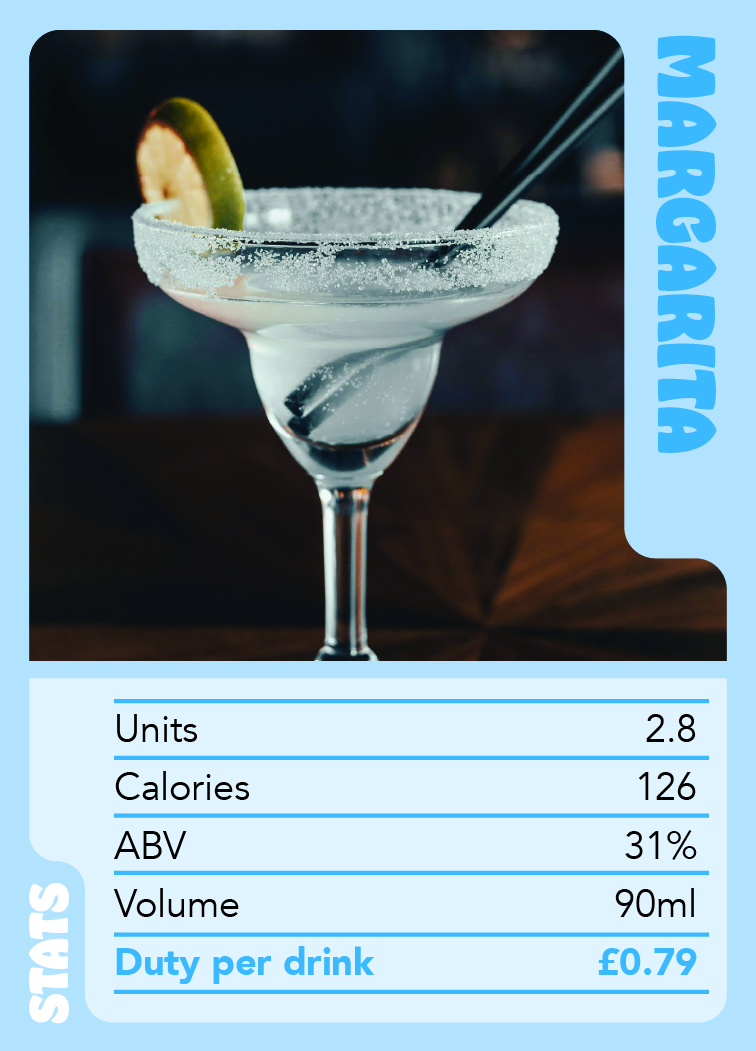

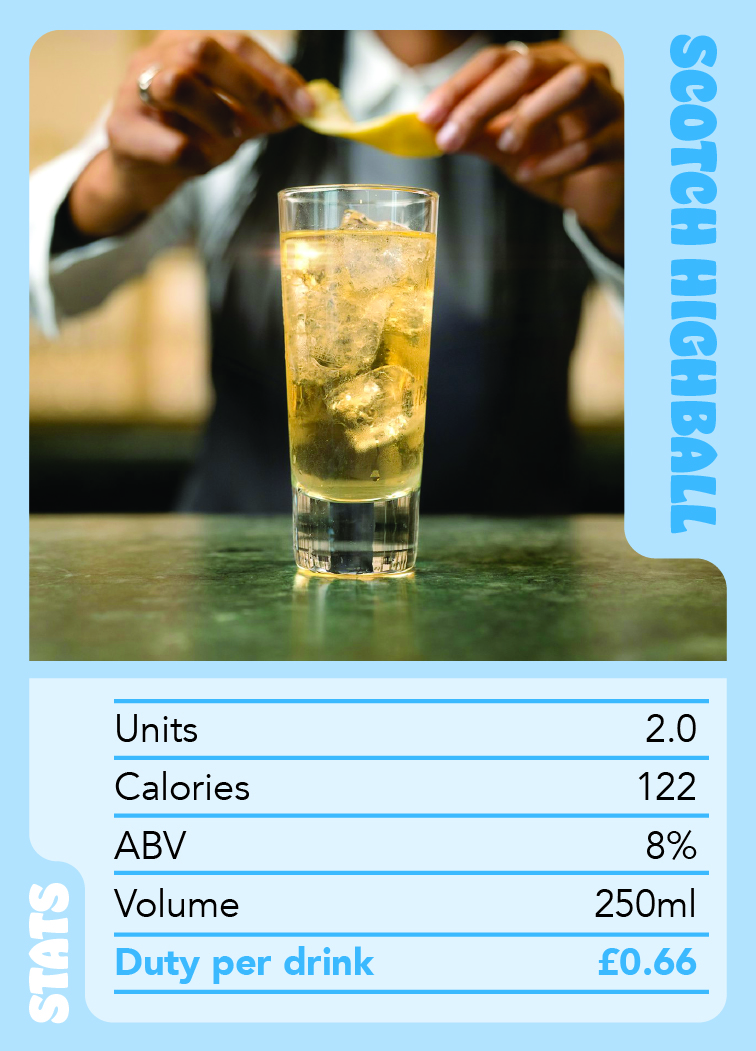

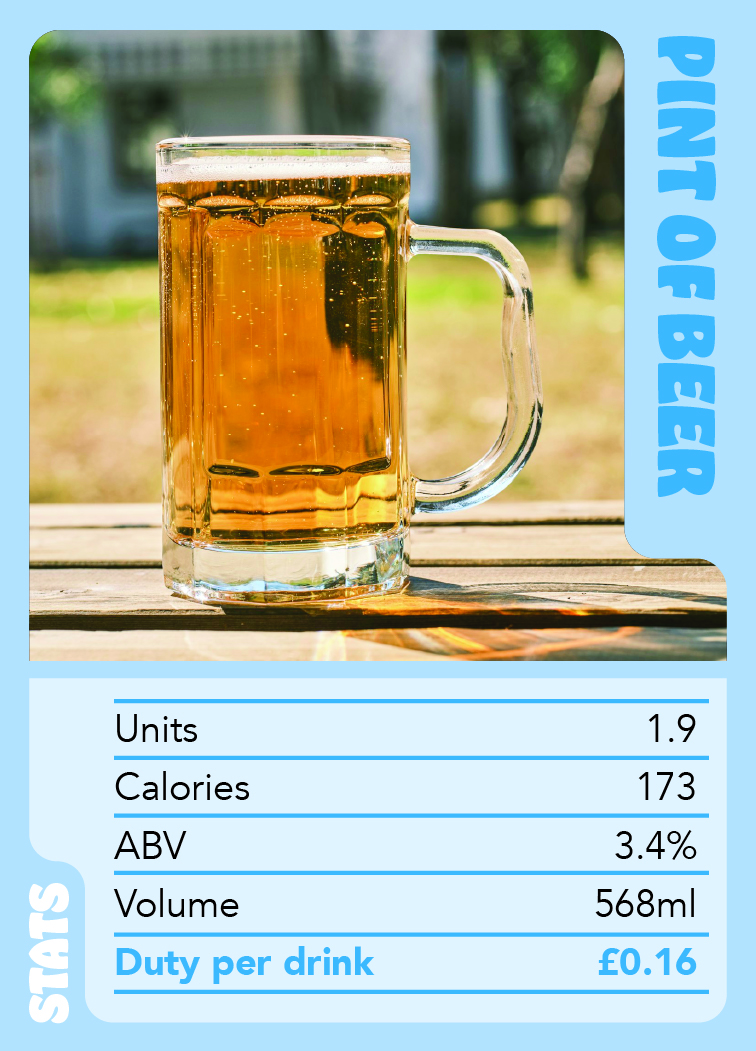

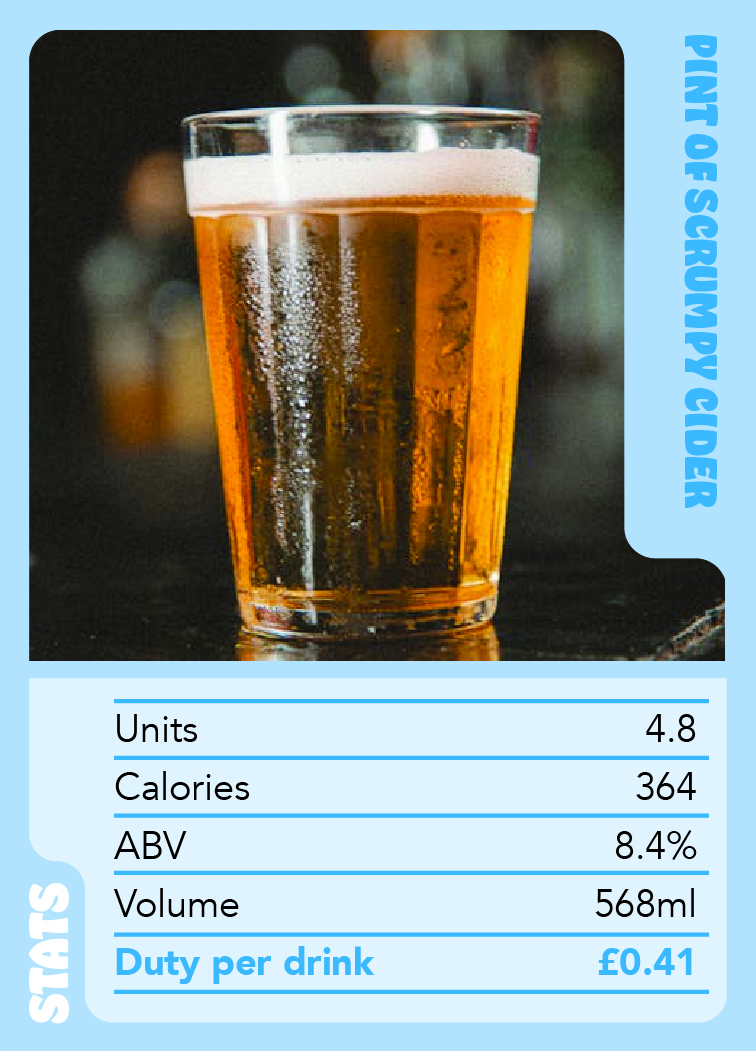

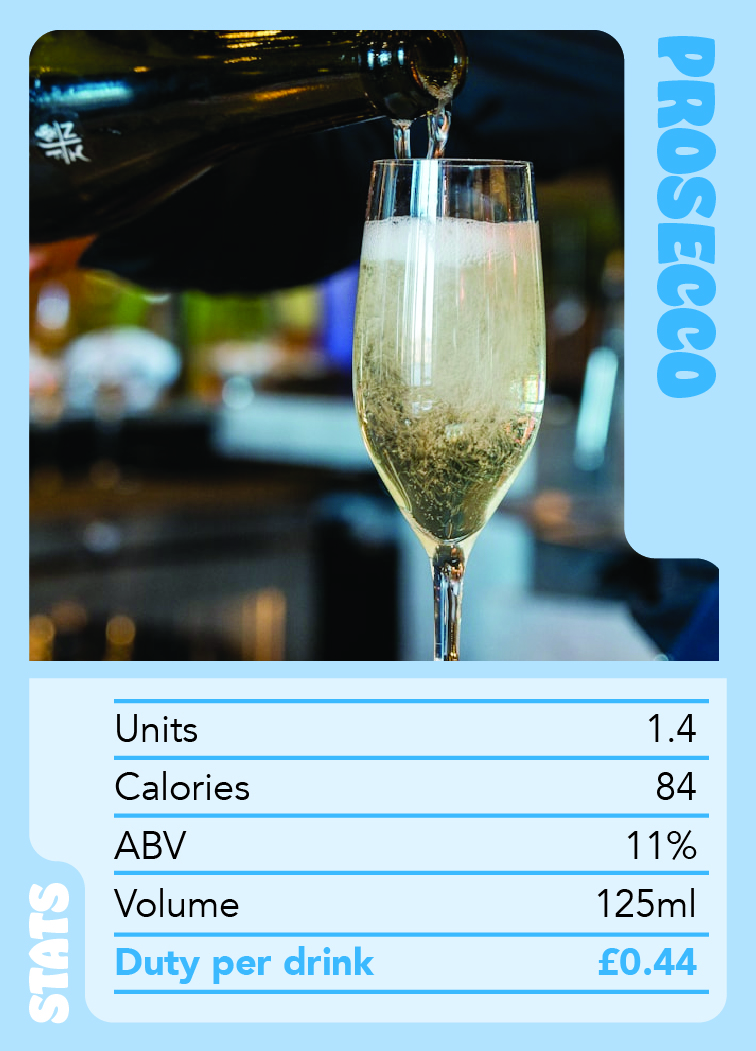

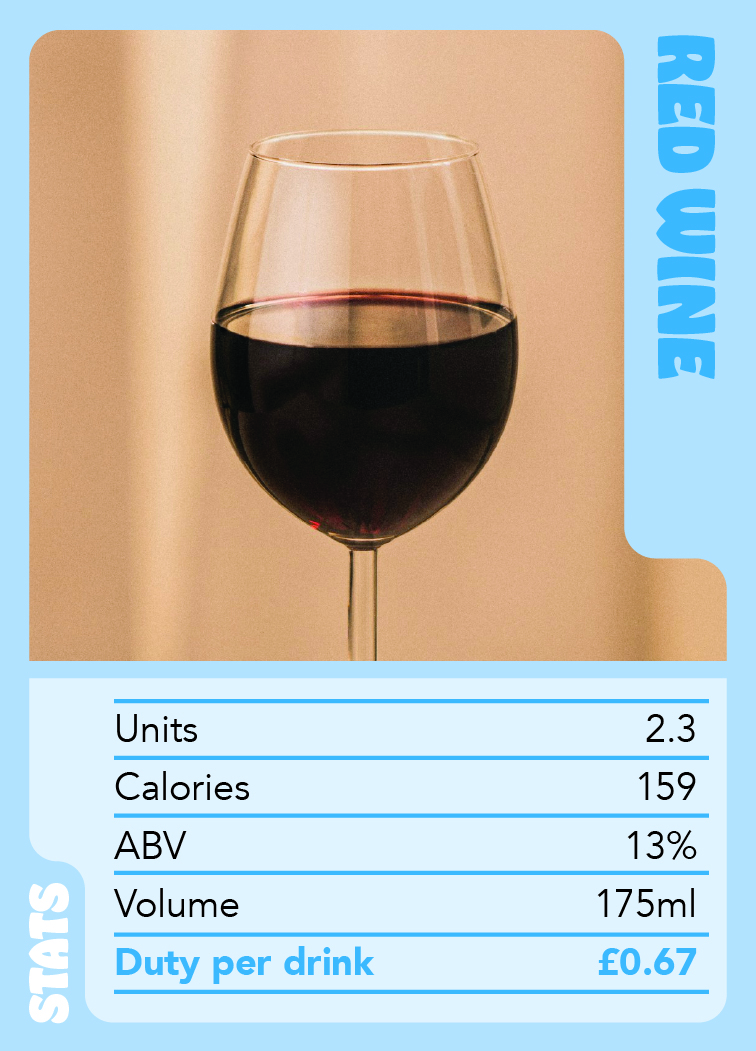

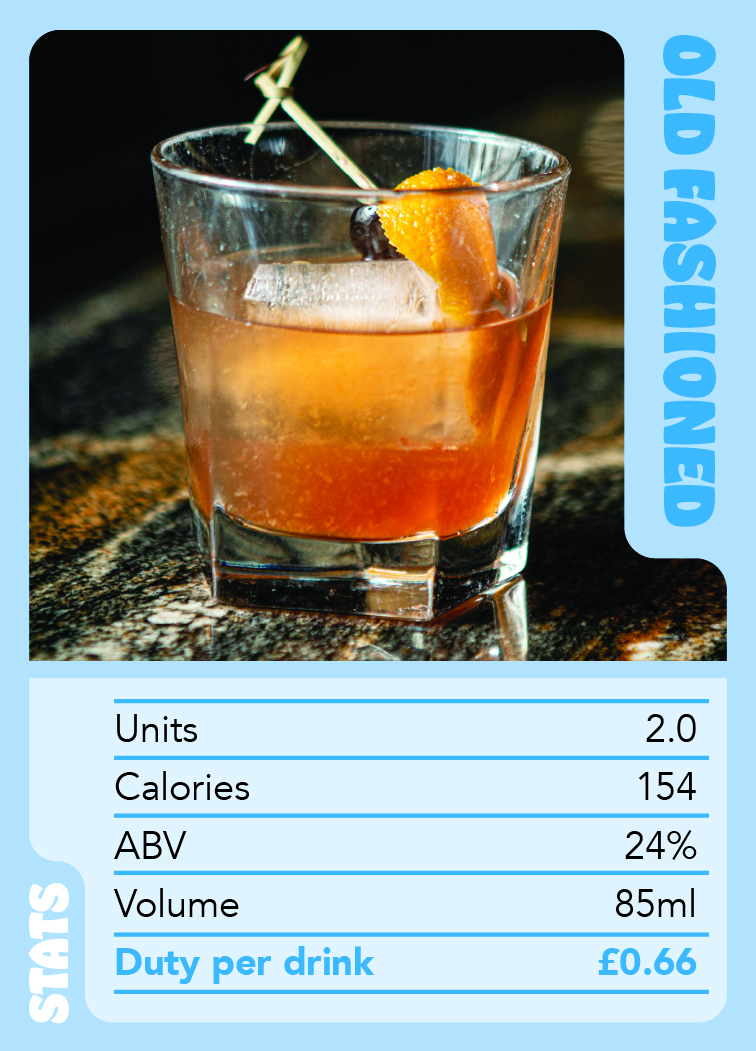

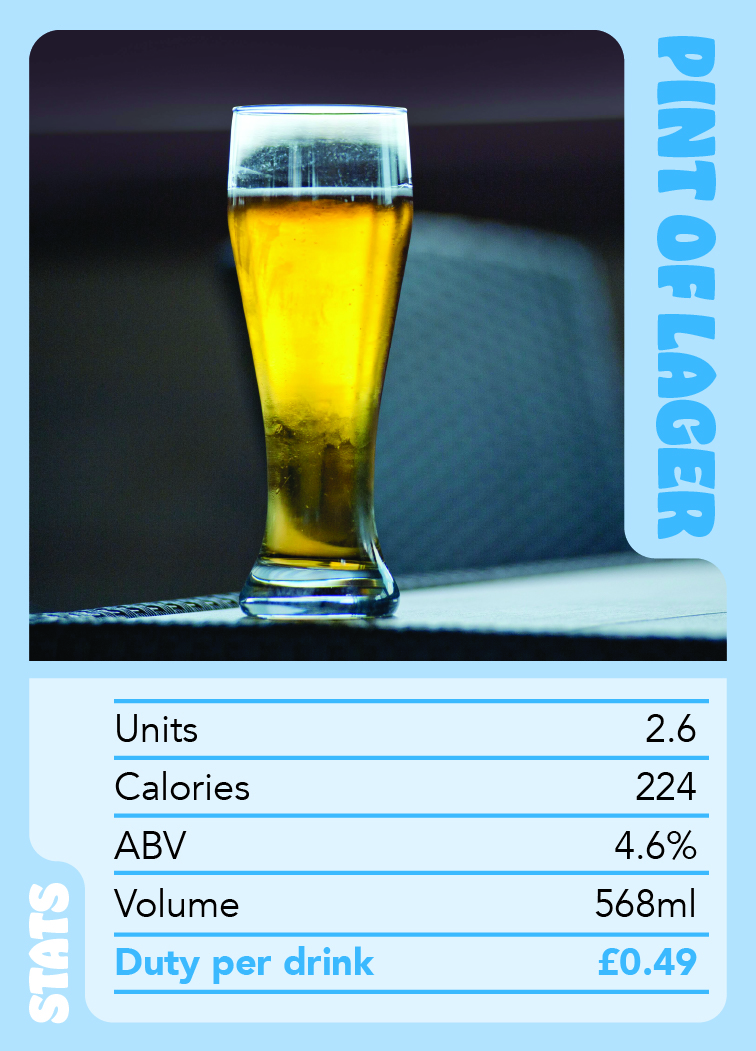

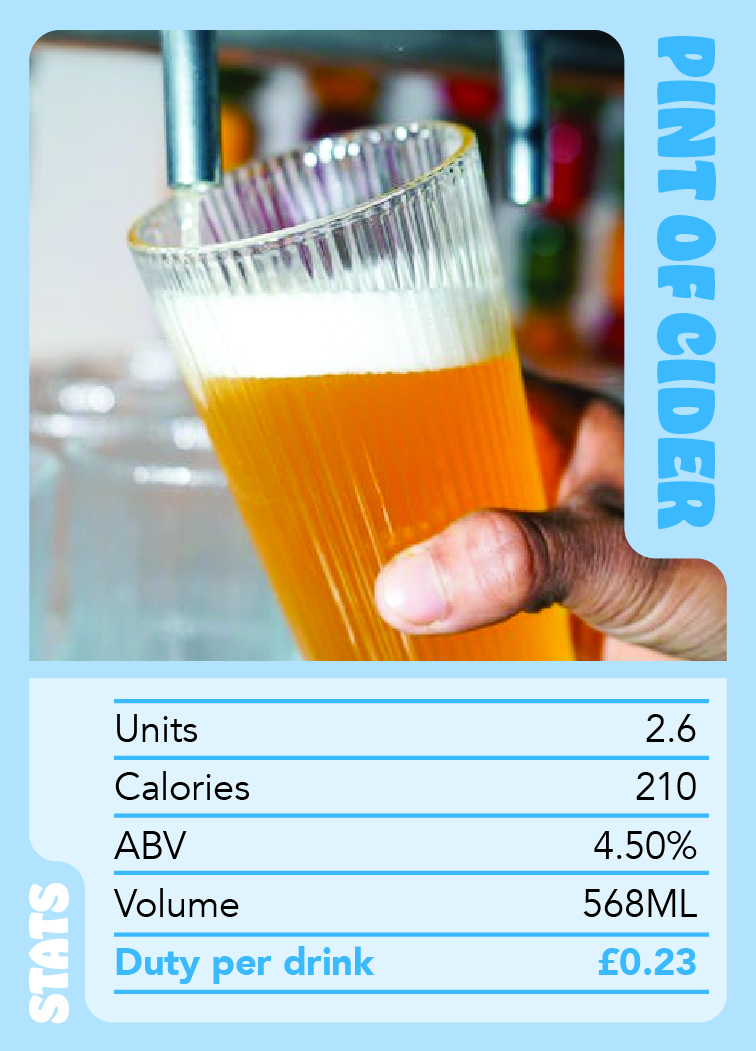

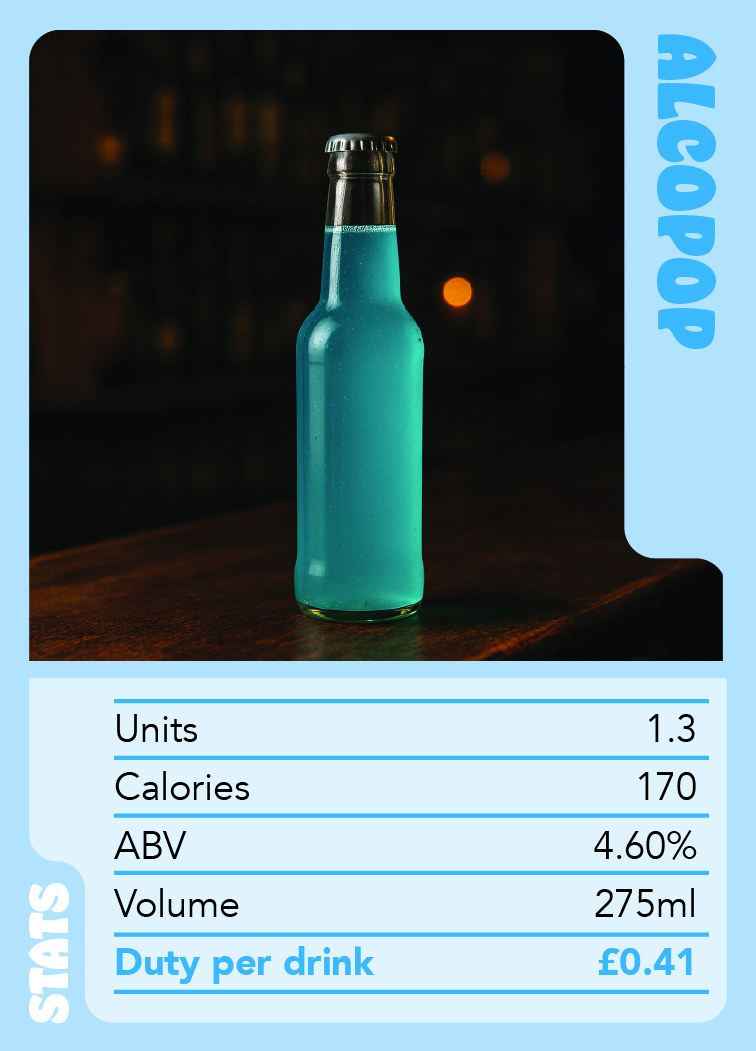

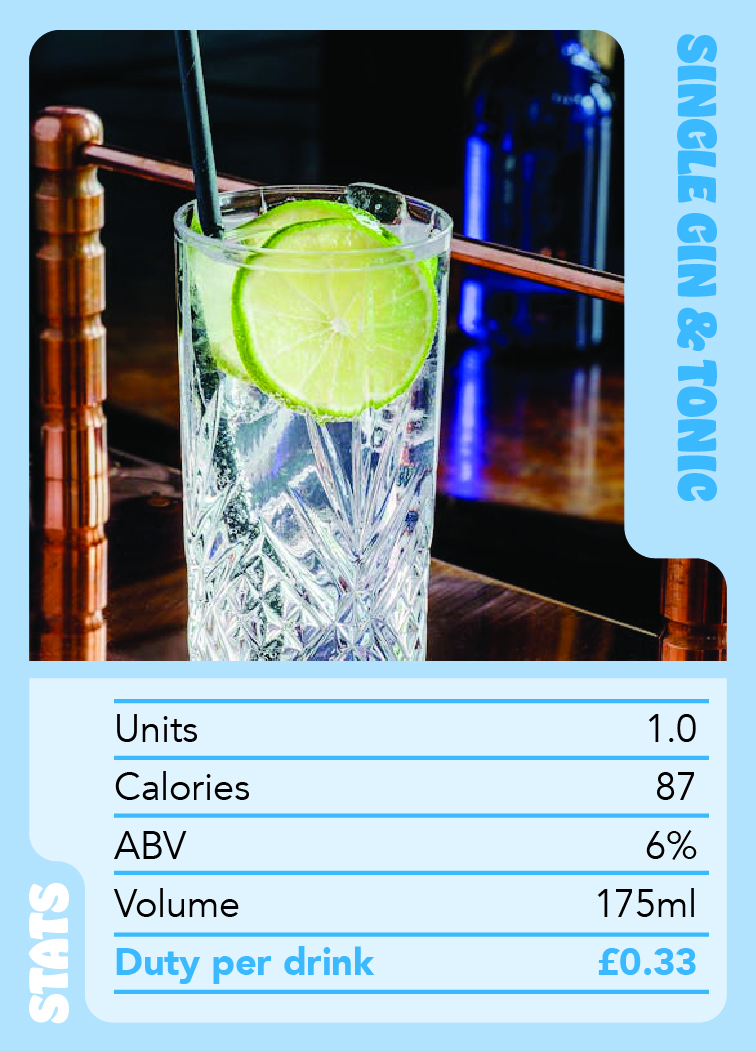

Pour Scores lays bare the stark differences in tax paid on different alcoholic drinks, regardless of the number of units they contain. Beer and cider are significantly lower in tax than spirits, despite having more units (and more calories) per drink.

How to play

Choose your go-to drink(s) from the deck, and take a look at the unit count versus the amount of duty paid per unit. Compare two different drinks - cider with Scotch Whisky, for example. Very often, spirits come out lower in units, lower in volume and calories, but far higher in alcohol duty.

Doesn't seem fair? That's because it isn't!

Spoiler: this isn't a real game.

And a good job too, because nobody wins when categories aren't given a level playing field.

A fair duty system would align with recommendations from the Chief Medical Officer, which doesn't discriminate between categories according to the strength of the product. Spirits are taxed significantly more than beer, wine and cider, despite a standard spirits pour at the bar containing fewer units - whether it's neat or with a mixer.

We're calling on the Chancellor to ensure that the tax gap between spirits and other alcohol categories doesn't continue to widen in the next Autumn Budget. As well as representing a fairer approach to UK excise duty overall, this will support spirits businesses to keep investing, innovating and employing, in turn boosting productivity and economic growth here at home.

Sources

Drinkaware

Food and Nutrition NBRI

Nutracheck

Medline