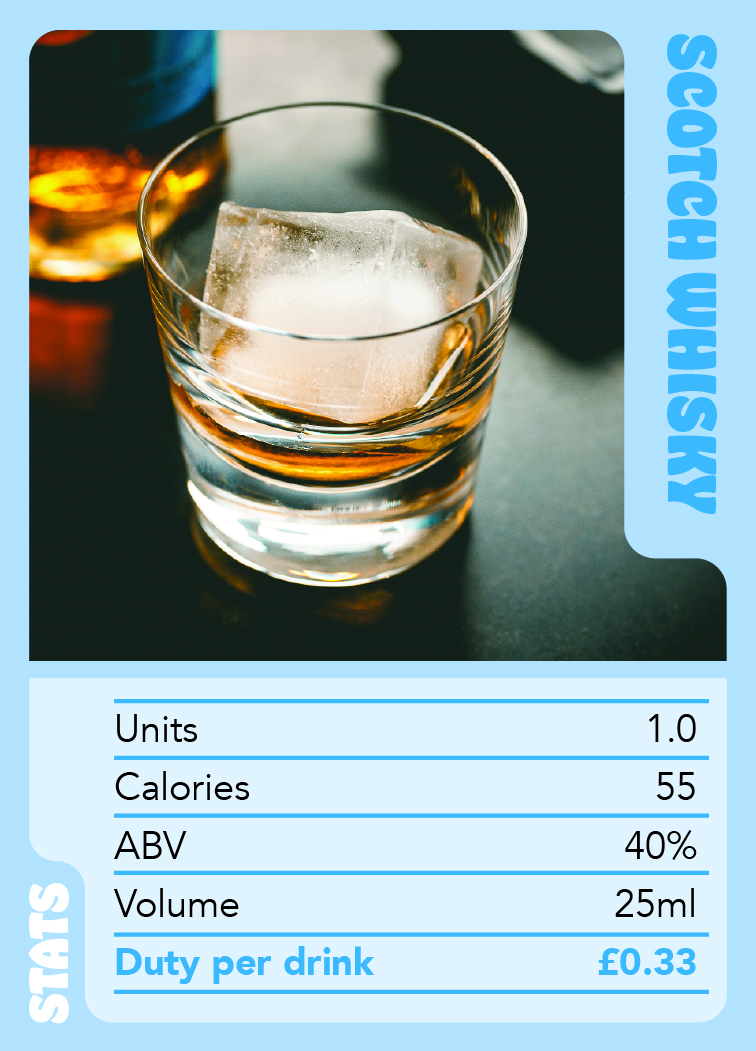

Join the campaign for fairer tax on Scotch

As the UK’s biggest food and drink export, Scotch Whisky is integral to the government’s growth agenda, boosting jobs and investment here at home.

The facts

- Scotch Whisky exports were worth £5.4bn in 2024

- The Scotch Whisky industry supports 66,000 jobs across the UK

- There were 2.7m visits to Scotch Whisky distilleries in 2024

Read more about Scotch Whisky's economic impact here

Did you know...

The Scotch Whisky industry contributed £7.1 billion to the UK economy in GVA in 2022.

The challenge

Scotch Whisky producers are facing economic headwinds, both here in the UK, and in our key global markets.

At home

Spirits like Scotch Whisky make up a third of sales behind the bar, but duty hikes from the Treasury have seen the price of a bottle of Scotch Whisky rise significantly following a cumulative 14% duty increase in just two years. Input costs to produce our world-class spirit are rising, including employment costs, raw materials, and the additional burden of Extended Producer Responsibility fees.

In global markets

Tariffs in the US – our biggest market by value – are impacting producers’ certainty, planning and market share. The UK-India FTA was welcomed by our sector, but the gains we will see are long term – perhaps 10 years into the future. Security and confidence for our exports is needed now.

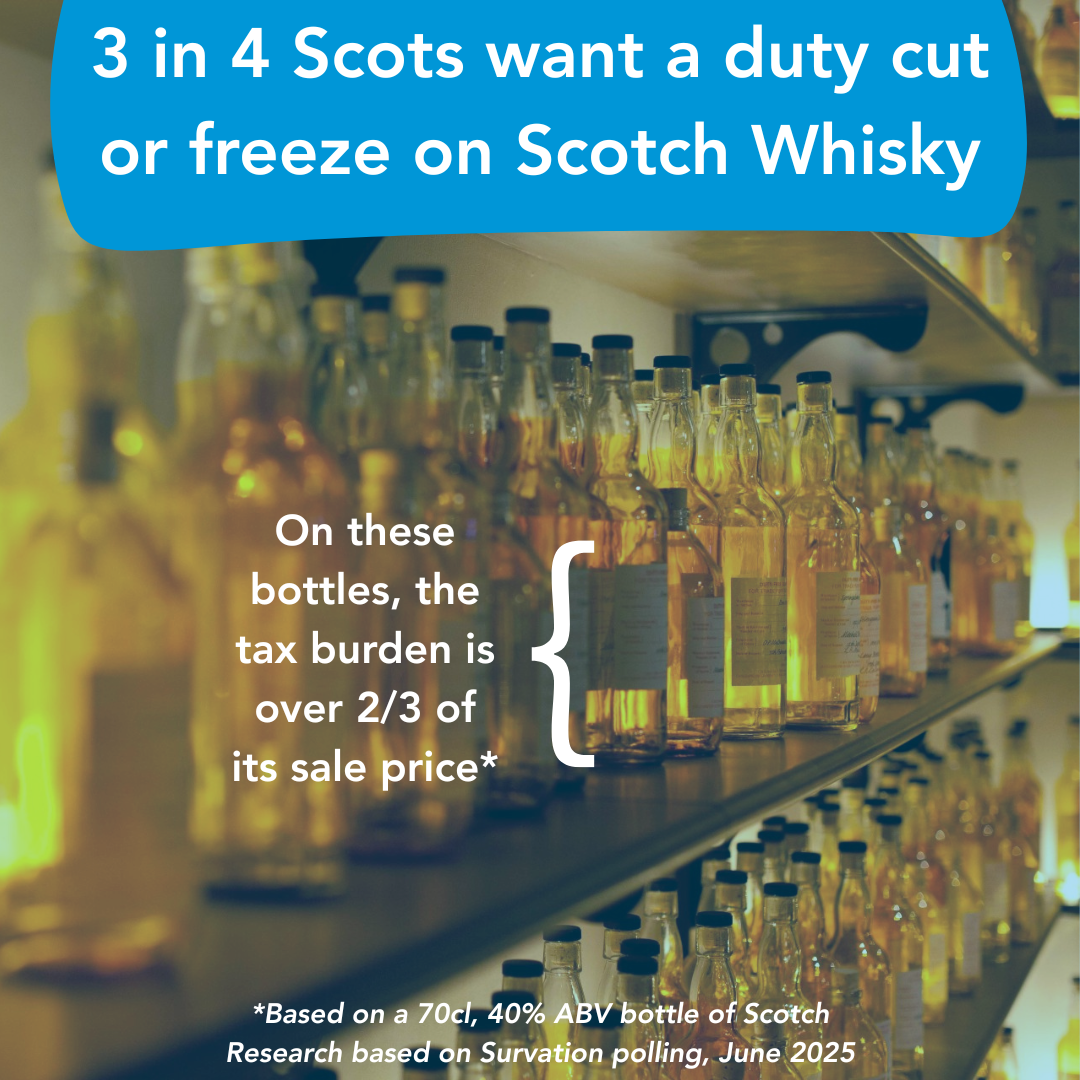

Voters want to see Scotch supported

Treasury revenue is flatlining

The Treasury recent duty increases have not delivered the promised revenue. The OBR recently revealed that forecasts had been overestimated, and that bears out in HM Treasury receipts: in 2024-25, £4.165 billion was collected in spirits excise duty, £676 million (14%) less than the OBR’s two-year forecast in March 2023.

Despite a cumulative 14% increase in spirits duty since November 2023, the Treasury’s revenue from spirits have flatlined.

What can be done?

Ahead of this year’s Budget, it’s vital the Treasury listens to the on-the-ground concerns of businesses as we call for greater support amid a challenging and unpredictable economic climate.

The Chancellor must take action to reduce the globally high tax burden in the UK Autumn budget. This will take the pressure off producers, give companies the breathing room to invest, and nurture a home-grown product from grain to glass, from Annandale to Orkney.

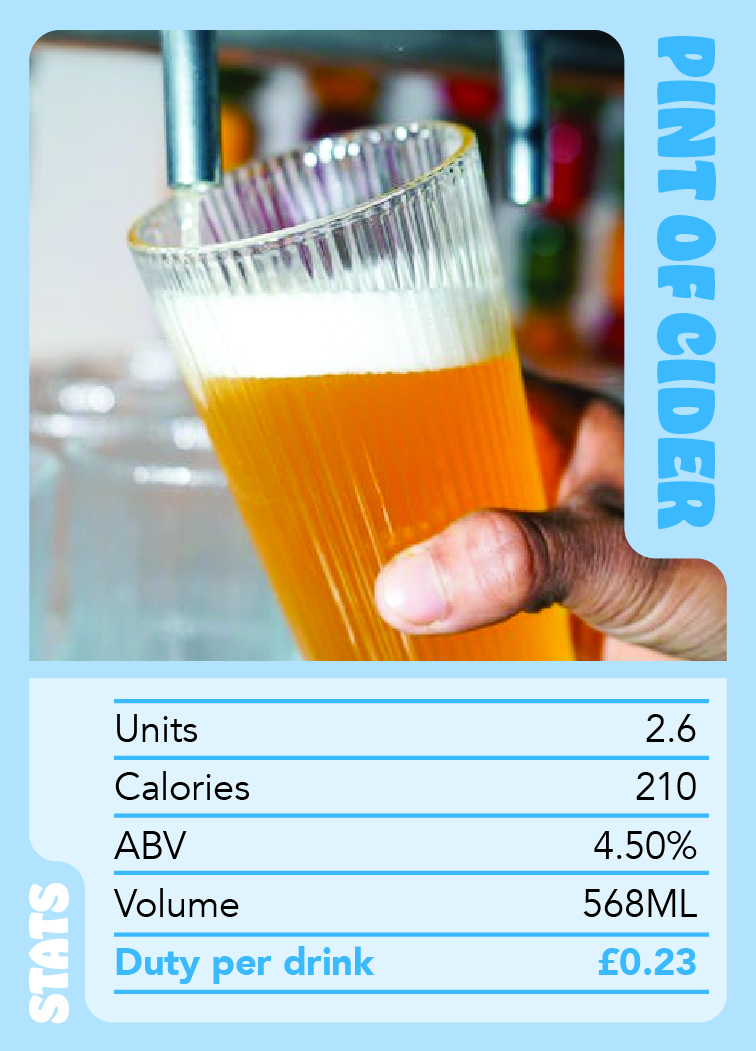

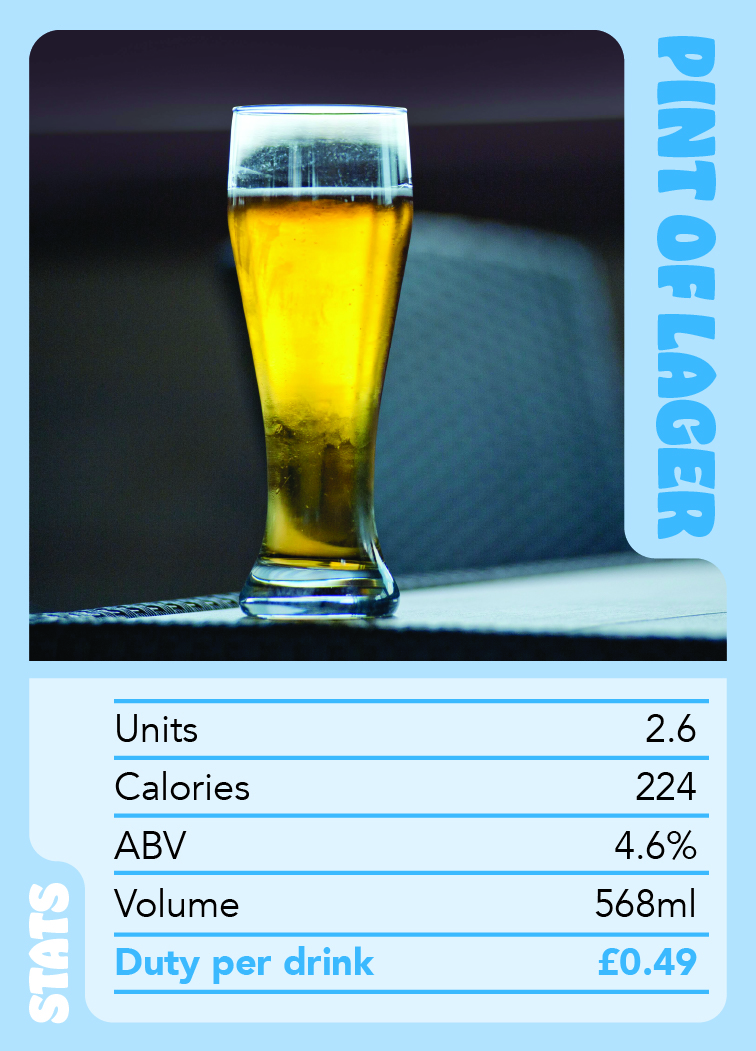

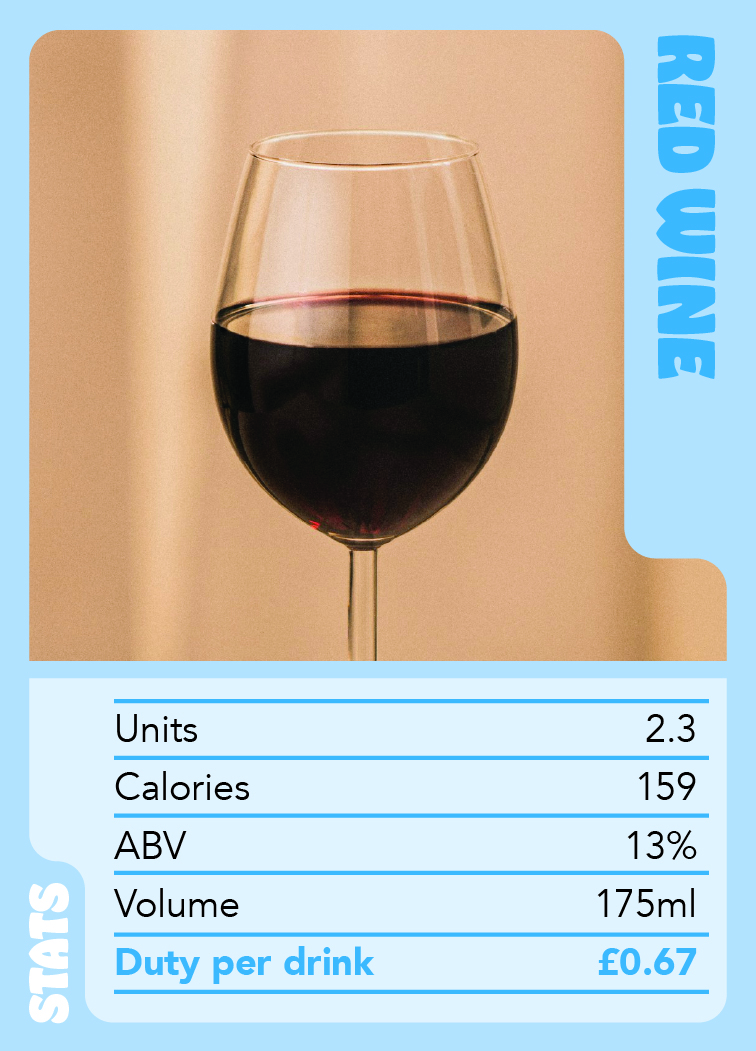

Explore Pour Scores

Tax disparity isn’t a game. Learn more about the differentiation and unfairness of how spirits are taxed vs other alcoholic products like beer and cider, despite being lower in both units and calories per drink. Higher strength doesn’t mean higher harm, and shouldn’t mean higher tax.